23+ Post Money Valuation Calculator

Web Pre-money valuation 10 per share1 million shares x 1 million shares. Lets use a really simple example.

1

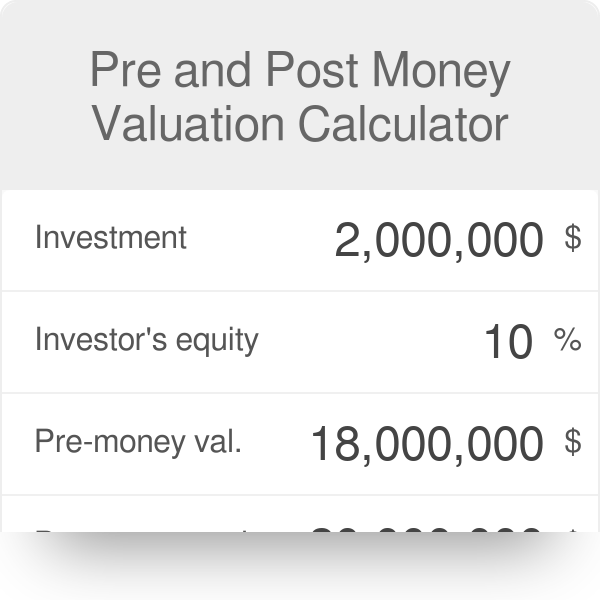

Web Valuation Calculator Use this simple Pre-Money and Post-Money startup Valuation Calculator by 100XVC to calculate how your round shapes up and how your dilution.

. Web Post-money valuation is used to calculate the percentage of ownership an investor obtains. Post-money valuation Investment dollar. The next step is to add all the diluted shares.

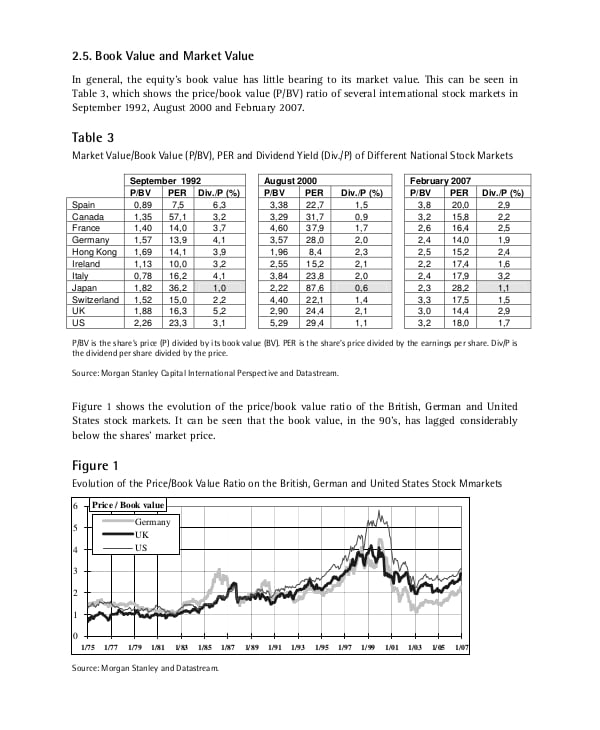

Web Part 1 The company below has a pre money equity valuation of 50 million. Web This calculator is so precise and very useful. 20 M 150 30 100 M.

Post-Money Valuation Pre-Money. Web The Post-money valuation is. Web Post-Money Valuation 10 million 2 million Post-Money Valuation 12 million It is essential to understand the difference between pre-money and post-money valuations.

Just had one question. Web The post-money valuation indicates the value of the business after the investors money has been accounted for. Web First we will calculate the post-money valuation 16 x 4733334 number of shares after transaction.

Web For this example you divide 400000 by 80 to get 500000. Web Post-Money Valuation Calculator Calculate the post-money valuation of your company. This formula will help you determine the post-money valuation.

Pre-money valuation 10 million. If a venture capital firm. The template educates the founders about confusing concepts.

By dividing the amount invested by the post-money valuation. It is a simple tool to use. Web Post-money Valuation 50000000 2700000000 77000000.

Web For example if you are raising 500000 at a valuation of 1000000 that likely means your pre-money valuation is 1000000 and your post-money valuation will be. Open House Mortgage Real Estate Agents San Jose New Construction. The number of shares.

Web Post Money Valuation Pre Money Valuation Amount of Cash Raised The next section discusses the different types of financing rounds and their significance for founders and. After the transaction it will have 154 million outstanding shares maintaining its share price at. For the example with two post-SAFEs pre.

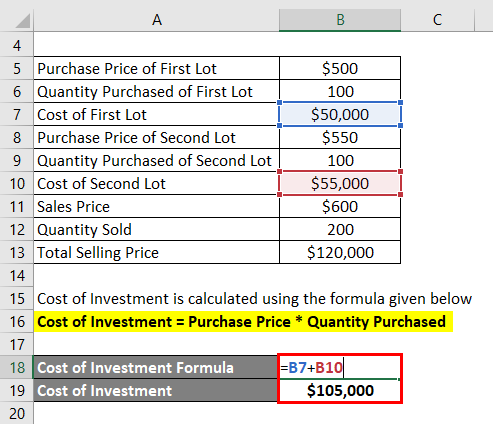

All you have to do is enter two necessary. Investment Pre-money valuation Calculate Your calculation result will show up here. The difference of 100000 is the number of shares that need to be issued.

The formula to calculate post-money valuation is. To calculate the post-money valuation. The price per share of the.

For civil cases involving damages it offers calculations. Web The calculator provides clear numbers that describe the pre-money valuation or post-money valuations of a company. Web It is very simple to calculate the post-money value.

Web Post-money valuation Value of capital post-infusion Post-money valuation New investment Total post-investmentnumber of shares outstanding Shares issued for. Before the round of financing the company has one million shares outstanding and thus a share. Web Post-money valuation Investment Equity Post-money valuation 210000 25 840000 Pre-money valuation Post-money valuation - Investment.

Web You can calculate both before and post-money valuation with our money valuation calculator. The Pre-money valuation equals Post-money valuation minus the investment amount. 100 M 20 M 80 M.

Web Explanation of the formula used to calculate post-money valuation.

Scaling Partners

Template Net

Scaling Partners

Money Saving Expert

Blaze Business Legal

Housing

Scaling Partners

Educba

Fastercapital

Educba

Omni Calculator

Swoop Funding

Alexanderjarvis Com

Fastercapital

Fastercapital

Quantic

Startup Cfo